Overview

About This Club

- What's new in this club

-

style2holl1s joined the club

-

FlorinV joined the club

-

Ofc! S&p 500 is a great investment. It s a set and forget type of thing. Etf like voo and spy adjust them self to index changes soo you don t have to do anything but set money in it when ever you want. The management fees are also very low, on short term it s not significative but on the long term, it huge. Investing on steady basis ( dca + snowball effect) has great potential 🔥🔥

-

I recently started to analyze ETFs since I have some money to invest. The US economy will continue to grow in the next 50 years or so. Let them be involved directly or indirectly in wars and that will happen for sure. So investing in S&P500 ETFs is one of my my tickers to move one.

-

blast3r joined the club

-

Most people won t beat index funds, soo as a diy investor, having a strong base of them get you a good start. The s&p 500 is averaging returns of 10% yearly. It is a great core base. You set investment in automation and forget it. You won t regret it. Voo has grown 23,10% this year. Nasaq 100 is a great growth engin. It index the top 100 tech compagnies in usa. While it s more volatile, the upcomming of IA give perspective of great return in the furtur. QQQM has grown 50.95% this year.

-

I luckily got into that situation where I could acquire some spare money. The bad part in this part of my life was that it happend right at the time when the inflation decided to snort some cocaine and could beat Mike Tyson in their prime (check Hungary inflation recently), so I had to make a decision what to do with my very little spare money that I want to put aside to situations when Im in trouble or if Im lucky enough to let this money become part of my pension. I decided that the stock market is a good place to do this. I was thinking about government bonds, but I wasnt very convinced looking at the governemnt of Hungary... but I will not go into details about that So I found Tastyworks, where I can buy ETFs. I decided to mainly buy ETFs that are based on SP500. Since I find it very unlikely that the entire economy of USA will default soon without warning without any way to revert it, and that historically it gives on average a return of 10% per year I decided to purchase some of these kinds of ETFs. The majority of this happend on 2023 feb 21. Altogether I bought some shares and my current "profit" stands at 18% as of today, but this can change rather suddenly I strongly believe that I shouldnt start day trading unless something huge happens. My friend who has been trading in shares for 20-30 years has a lot of experience and he seems very confident it is not possible to beat the market with daily trades So unless I see something very unexpected to happen, Id just keep my shares on long term, and when I have some extra cash, buy new shares to increase this exchequer of mine until I have no other option but to use this Although if things go very good moneywise, I have some other plans, but thats in the future that will decide about it, while I go with the flow. I have also bought some crypto coins. But I planned to buy no more than 5% of my maximum investment. Last time I checked I had about 30% "profit" on that, when I bought it in around 2022 dec 20.

-

Vindstot joined the club

-

TD Ameritrade recently merged with Charles Schwab and I am really enjoying the Charles Schwab platform. Research/alerts are well organized and cleanly displays everything I want. I support your thinking @Eazy -- I have always been an advocate of long-term investing (Warren Buffet agrees too!). My best approach (I am not a financial advisor by any means) is reading through all press releases, 10-Q, investors page of company, and general industry news. Once I go through those steps, I eat some ice cream as I ponder the potential investment xD

-

mraw435 joined the club

-

ETF I m invested in VFV.to , that is the canadian unedge version of vanguard s&p500 (voo) , i m also into qqc.to who s the canadian unedge version of Invesco nasdaq 100 (qqqm) . SCHD is a dividend etf that i hold for it s growth and dividend growth. As for stocks I hold TD.to , it is a canadian bank with strong growth history , in operation since 1965 before that merge it was bank of toronto (1855) & dominion bank (1869). BN.to , Brookfield Corp, they are a corporation and bankers & assets managers. They are in some point similar to Berkshire Hattaway (without Warren Buffet & Charlie Munger). Bam.to , is a subsuidary of the Brookfield corp. Only managing assests. T.to , Telus telecom. They are a big player in the canadian telecom industy. And distribute a juicy 5.75% dividend. Hold a few mores stuff in other accounts.. i ll share in an other day. Maybe i ll ressurect the trading Club 🤞😬

-

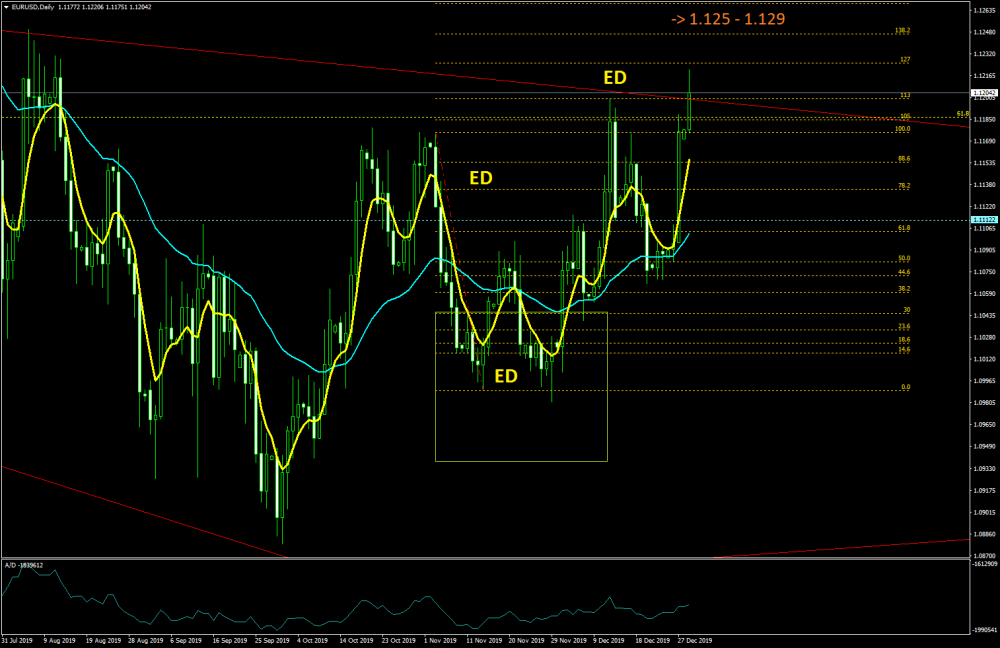

Sorry i m reviving old tread 😬 . Day trading is actually hard and not really profitable at least when you start. To day trade you need to get informed and follow really closely what s going on in the market. Imo, long term is easier, you get a few good etf such as the s&p500 or total stock market and you dca thoses positions. Building a core portfolio of strong index fund will assure you some growth overtime without needing to do the research. Once your core is built , you can go and build a "coffee can" portfolio , purchase blue chips that you believe (based on research) has the potential to grow and thoses too should be long term positions. To give you an idea about the index fund, here is the chart of the s&p500. You ll see that staying invested and dca has been profitable on the long term.

-

rezta joined the club

-

nAbish joined the club

-

Only invest what you are willing to loose

-

I'm not really attracted by crypto but in the same time I'm sure there's lot of money in crypto. So if I had too much money I would get some but unfortunately it's still not the case 😅

-

ASBO joined the club

-

Anyone buying holding or buying/selling crypto currencies? What kind of indicators do you use? What are your strategies? Have any interesting companies? I personally don't trade much, I like buying and holding for a longer timer (1+ years). Currently I only have CRO (from the company crypto.com). Also looking at algo and zil, but haven't bought them yet.

-

Karla joined the club

-

Smultronstallet joined the club

-

My strategy is buy GME and hold. 😛 All kidding aside the majority of investmetns are in S&P500 index funds/etfs. Playing the invest x amount per month for 40 years for retirement. Then a small amount I use for buying some individual stocks and crypto currencies.

- 1 reply

-

- 2

-

-

Who is trading what and what platform?

Mr.Karizmatic replied to daredevil's topic in Trading's Topics

well just started trading for the first time in my life on zerodha . Let see how it goes, considering to go with day to day in the start till i understand and then go for long term. @daredevil what u think -

Eazy joined the club

-

Flible joined the club

-

Mr.Karizmatic joined the club

-

RainierWolfcastle joined the club

-

Hello, Considering the current situation, I don't dare to let my money in the market for a long run. I want to be able to pull it out as as fast as I can. That's why I'm kinda day-trading. My strategy is based on the Elliott wave principle (https://en.wikipedia.org/wiki/Elliott_wave_principle). It's very easy to understand. I can't predict if a stocks will go up in the long run but if a stock is crashing (like -5%) and it wasn't near his all time highest you will easily win 1% the day after. BUT you have to watch the value. For example I bought a stock that was -4%, the day after it was down -1% at the end of the day but before the close, the value oscillated between +1,5 and -0,5% before reaching -1% and I sold it at 1%. I'm fairly new to the market stock but for now it worked. I don't have enough data but it worked as expected 3 times out of 4, giving me a 3% yield till now. I will follow this strategy as often as I can but I'm tempted to go for a long run in a near future (if a cure is found for corona).

- 1 reply

-

- 2

-

-

-

Hesis joined the club

-

hobbit joined the club

-

It's not the end of the dollar rise yet. In the short term, it will rise in a moment, and then the correction. We're making a flat 4 wave. Don't lean out too early with sales! We've got a strong coverage of the bull market with a simultaneous breakout from the growth channel to the W1 USDX.

-

-

-

Are you sure about that? "The killing of Gen Qasem Soleimani, commander of the Iranian Revolutionary Guards' Quds force, represents a dramatic escalation in the low-level conflict between the US and Iran and one whose consequences could be considerable." https://www.bbc.com/news/world-middle-east-50980704 I was expecting an offensive on Iran already in 2012. But then another unlimited QE came and the plans were put aside. Now the stock exchanges need a correction, so a larger scale armed conflict is needed. Perhaps there will be a system reset within a decade (cancellation of all debts and creation of new currencies - like BTC?). The SP500 is already at a potential peak. Edit: Iran rolls back nuclear deal commitments- BBC News

-

-

-

Is that a bounce? Extent of the correction -> 1.1045-1.0945

-

-

Bleed joined the club

-

-

No. I studied Elliot Wave a little many years ago and didn't find anything particularly clarifying about it. I found that it fit nicely into that category of the story about rats. As much as the explanations of crowd psychology seems to fit quite nicely I didn't find the wave patterns and semaphors (as some wave pattern indicators call them) particularly useful in anyway. I'm not saying don't do it. But I don't. I have tried 100's of indicators. Maybe more than one thousand. I don't use any. Indicators are only derived from data already in the chart. When you watch price action for long enough you begin to get a feel for when the stochastic is gonna flip. Or worse. When that stochastic reversal is a fake out that then redraws the axis within the stochastic indicator. As I was lying awake in bed last night it did occur to me that I never mentioned that the "something" I saw in that aussie chart above was price hitting a pretty (clearly) solid resistance level and pretty closely in confluence with a downward aimed horizontal channel. I want to be clear though. I believe charts are charts. I do not believe that any trading vehicle is any different than any other one. A long time ago I chose forex because I believe the intraday volume traded gives me the best/worst chance of making money. Personally, I find reading about global markets and the politics driving them to be the most interesting. I don't like corporate culture, ceos, and reading balance sheets. I find that quite boring so I steer clear of equities. Just my religious views but I have traded equities and futures and cryptos. I just like what I like. I have lost an indicator many years ago which I am trying to hunt back down. It was a custom candle indicator which let you make things like 2 day charts and 3 hour candles but I haven't found a replacement for it that I am happy with. All the latest versions are poorly coded. When I find a good one I will upload it here for everyone to try. Provided you use MT4. That being said, why would I need it? All the data is already in the chart anyways Please don't mistake me for bashing indicators though. There are a few fascinating ones out there which I would love to discuss at length. Most of them simply become a tool I learn to see though and don't need cluttering up my screen. There has been a few studies that suggest, quite convincingly, that if you were to just flip a coin and buy or sell based on the result, applying very solid money management: you would find a surprising amount of success. For some reason I think the book "A Random Walk Down Wall Street" might allege the same thing.

-

I have seen many traders trading on EW for Forex? Do you follow EW theory for it?

-

Upcoming Events

-

About Us

We are glad you decided to stop by our website and servers. At Fearless Assassins Gaming Community (=F|A=) we strive to bring you the best gaming experience possible. With helpful admins, custom maps and good server regulars your gaming experience should be grand! We love to have fun by playing online games especially W:ET, Call of Duty Series, Counter Strike: Series, Minecraft, Insurgency, DOI, Sandstorm, RUST, Team Fortress Series & Battlefield Series and if you like to do same then join us! Here, you can make worldwide friends while enjoying the game. Anyone from any race and country speaking any language can join our Discord and gaming servers. We have clan members from US, Canada, Europe, Sri Lanka, India, Japan, Australia, Brazil, UK, Austria, Poland, Finland, Turkey, Russia, Germany and many other countries. It doesn't matter how much good you are in the game or how much good English you speak. We believe in making new friends from all over the world. If you want to have fun and want to make new friends join up our gaming servers and our VoIP servers any day and at any time. At =F|A= we are all players first and then admins when someone needs our help or support on server.

.thumb.png.f1b3fb39dccb3efc57bc1e63a617966a.png)